Download Form - Other Forms. Form N for appeal under Real Property Gains Tax Act 1976.

Sekiranya permohonan Borang N ini berjaya anda sekali lagi akan mendapat masa 30 hari untuk memfailkan rayuan terhadap taksiran yang dipertikaikan itu.

. Have been a lawful permanent resident of the United States for at least 5 years. Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference. Touch N Go Expenses.

Form N for appeal under the Income Tax Act 1967. PARTICULARS OF INDIVIDUAL For Office Use Date received - 1 1 Date received - 2 Date received - 3 This form is prescribed under section 152 Income Tax. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

The penalty after the Form J is issued under subsection 90 3 is for failure to submit ITRF gagal mengemukakan borang nyata and the rate is fixed at 45 refer point 4 of the GPHDN. Below is the guide to step-by-step on how to register LHDN Employer Tax. CP22 is a government report issued by the LHDN.

You are at least 18 years of age. The Malaysian Inland Revenue Board LHDN has issued a New Operational Guidelines on penalties under subsection 112 3 of the Income Tax Act 1967. Follow and subscribe to DayakDaily on Telegram for faster news updates.

Headquarters of Inland Revenue Board Of Malaysia. N MALAYSIA CUKAI PENDAPATAN Borang yang ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967 PERMOHONAN UNTUK LANJUTAN TEMPOH BAGI MEMBUAT RAYUAN KEPADA PESURUHJAYA KHAS CUKAI PENDAPATAN Seksyen 1001. Extension time of three 3 months will be given from the due date of submission.

Form E - LHDN. Part 1 Information About Your Eligibility Select only one box or your Form N-400 may be delayed Enter Your 9 Digit A-Number. This form must be completed and furnished together with the Form C by the company surrendering the loss under the Group Relief provision.

3 years at the time you filed your Form N-400. Two copies of Form 9 Certificate of Registration from CCM. The appellant must submit two 2 copies of the Form N for each year of assessment whereby one 1 copy is an original Form N while the one 1 other copy may be photocopied.

Example 2 Marina is an employee who receives employment income and she did not submit ITRF for the year of assessment 2014. Failure to do so can result in a RM20000 to. Borang-borang ini semuanya boleh diperolehi daripada laman web LHDN.

Module 2 Basic Human Resources Module Setup Unit 1. This form shall become part of the Form C pursuant to section 77 A of the Income Tax Act 1967. If the application for extension of time is allowed the IRB will issue a Form CP15A-Pin12009 informing the taxpayer of the.

The Inland Revenue Board Of Malaysia LHDN has reminded nonbusiness taxpayers that the deadline for submitting tax return forms TRF for the assessment year 2021 is April 30 manual submission and May 15 for online submission through e-Filing In a statement LHDN stated that as of 31 March 2022 the total. Similar to Form Q a Form N is a prescribed form that can be downloaded from the IRB website. Two copies of Form 13 Change of company name if applicable 4.

UOB SC Expenses Statement. Your Current Legal. The taxpayer must submit 2 copies of Form N for each year of assessment to the IRBs office handling that income tax file.

Sarah can appeal by submitting Form Q not later than 15052014. This form is acceptable as a letter of authority if completed and duly signed by the surrendering company. Form N can be downloaded and printed from the following link.

Return form for year of assessment 2021 involving petroleum with accounting period ending 1 January 2021. Two copies of Form 49 Name and the address of the directors. Two copies of Form 24 List of the shareholders of the company.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Creating Google Adwords Invoice.

Headquarters of Inland Revenue Board Of Malaysia. It is the employers responsibility to report the new hires to LHDN within 30 days of the new hires join date. LEMBAGA HASIL DALAM NEGERI MALAYSIA HASiL ANJUR PERSIDANGAN PERCUKAIAN KEBANGSAAN 2022 KALI KE-22.

Sekiranya berada di luar negara boleh ditunjukkan bukti anda ke luar negara dengan memberikan salinan pasport. Best judgement assessment was made by the DGIR and it was served on 15102015. CP 22 is a notification of new employee form.

The Inland Revenue Board of Malaysia LHDN has reminded non-business taxpayers that the deadline for submitting the Tax Return Form TRF for Assessment Year 2021 is April 30 for manual submissions and May 15 for online submissions through e-Filing. Return form for year of assessment 2020 involving petroleum with accounting period ending 1 November 2020 until 31 December 2020. 2006 Form LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF A NON-RESIDENT INDIVIDUAL UNDER SECTION 77 INCOME TAX ACT 1967 YEAR OF ASSESSMENT M 2006 PART A.

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

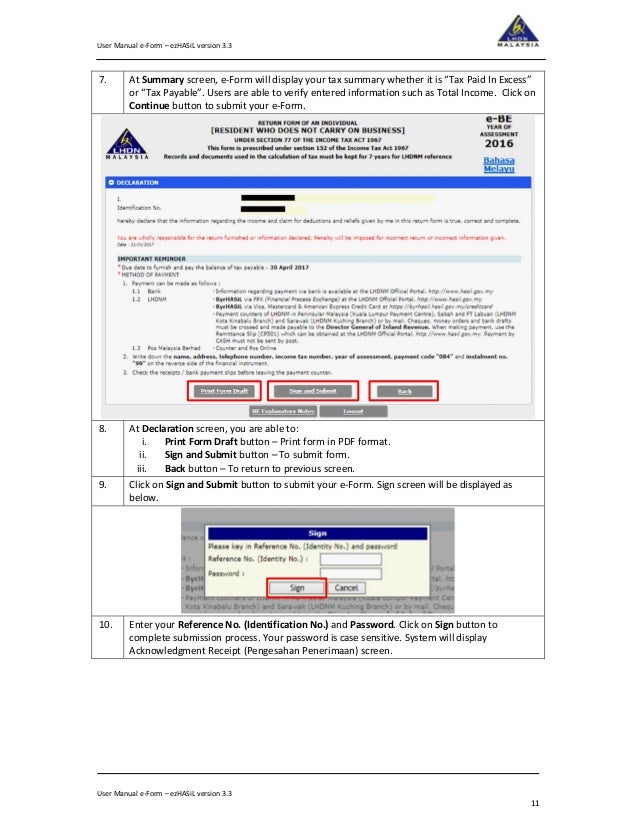

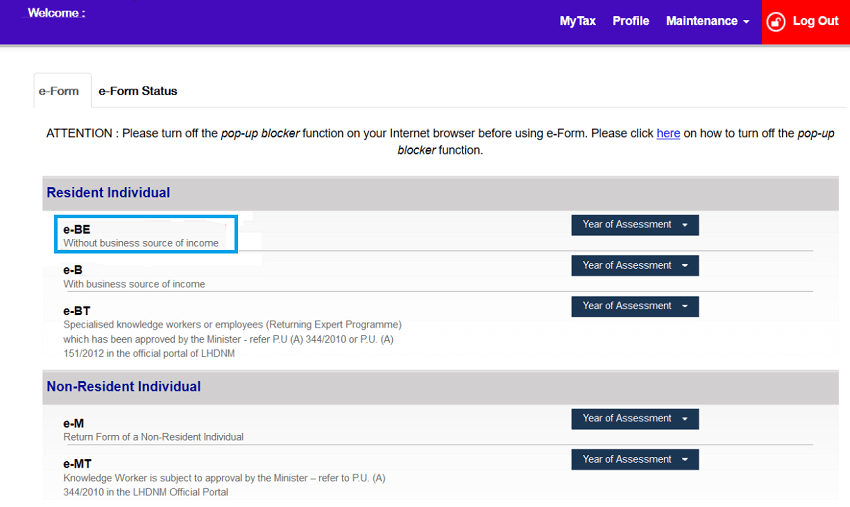

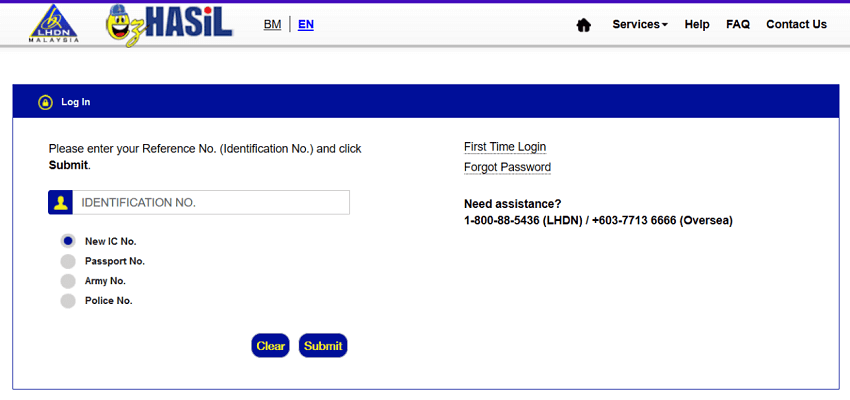

Ctos Lhdn E Filing Guide For Clueless Employees

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Ctos Lhdn E Filing Guide For Clueless Employees

Understanding Lhdn Form Ea Form E And Form Cp8d

Syndicate Issuing Fake Letters To Scam Taxpayers Lhdn Warns

Understanding Lhdn Form Ea Form E And Form Cp8d

Ctos Lhdn E Filing Guide For Clueless Employees

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Ctos Lhdn E Filing Guide For Clueless Employees

Ctos Lhdn E Filing Guide For Clueless Employees

Lembaga Hasil Dalam Negeri Malaysia